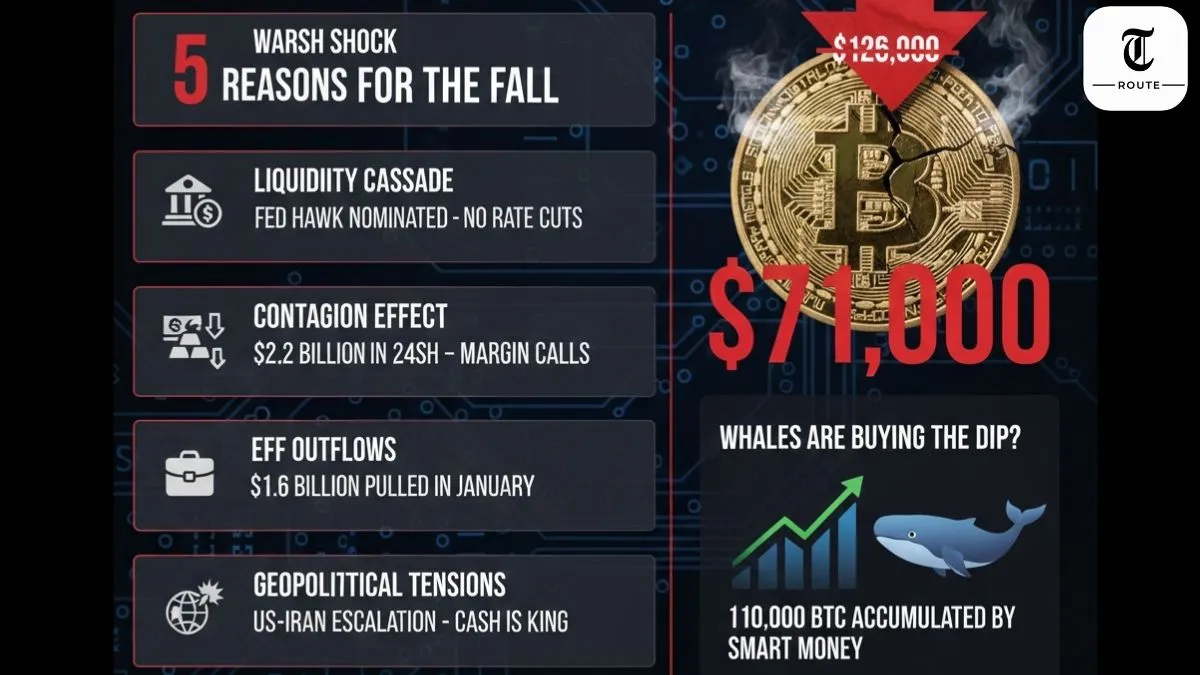

In the last 96 hours, the “number go up” meme has officially been silenced. After hitting record highs of $126,000 in October 2025, Bitcoin has entered a brutal correction phase, sliding below the psychologically critical $71,000 mark on February 5, 2026. This isn’t just a “dip”—it is a full-scale market regime shift.

At TruthRoute, we don’t just follow the price; we follow the capital. While social media is full of panic, the data points to a “Perfect Storm” of macroeconomic and technical factors. Here is exactly why Bitcoin is dropping and what the “Whales” are doing behind the scenes.

1. The “Warsh Shock”: A New Era for the Fed

The single biggest catalyst for this week’s crash was President Trump’s nomination of Kevin Warsh as the next Federal Reserve Chair. On Wall Street, Warsh is known as a “Hawk”—someone who favors tighter monetary policy and a smaller Fed balance sheet.

- The Impact: Investors had priced in multiple interest rate cuts for 2026. Warsh’s nomination suggests those cuts are off the table.

- Liquidity Drain: When the Fed shrinks its balance sheet, “easy money” leaves the market. Since Bitcoin thrives on excess liquidity, it is the first asset to be sold off.

2. The $2.2 Billion Liquidity Cascade

On Sunday, February 1, the crypto market saw its largest liquidation event since the FTX collapse. Over $2.2 billion in futures positions were forcibly closed. When traders use high leverage (borrowed money) to bet on Bitcoin going up, a small drop can trigger a “Margin Call.”

As these positions were liquidated, it forced even more selling, creating a “domino effect” that bypassed all technical support levels. Over 335,000 traders had their accounts wiped out in a single 24-hour window.

3. Contagion from Gold and Silver

In a bizarre twist, Bitcoin’s drop is being amplified by the “Safe Haven” markets. In late January, gold and silver saw their steepest single-day losses in decades.

Because many professional hedge funds use Portfolio Margin Accounts, they treat their gold and Bitcoin as one big pool of collateral. When their gold positions crashed, they were forced to sell their Bitcoin to cover their margin debts. This “Contagion” proved that in a crisis, Bitcoin is still behaving more like a “Risk Asset” than “Digital Gold.”

4. ETF Outflows: The Institutional Retreat

The “Spot Bitcoin ETFs” that fueled the 2025 rally are now seeing record outflows. In January 2026 alone, over $1.6 billion was pulled out of US-listed Bitcoin ETFs. This indicates that the “mainstream” investors—pension funds and retail advisors—are de-risking their portfolios in the face of global economic upheaval.

5. Geopolitical Tensions (US-Iran Escalation)

Rising tensions in the Middle East, including reports of explosions near Iranian ports, have triggered a “flight to safety.” Traditionally, this would favor gold, but in 2026, investors are moving into US Dollars and Cash. The “Safe Haven” narrative for Bitcoin has yet to hold up during active military escalations, causing traders to exit crypto in favor of the greenback.

Is There a Silver Lining? What the “Whales” Are Doing

Interestingly, while retail investors are panicking, on-chain data shows that “Whales” (wallets holding 1,000+ BTC) have accumulated roughly 110,000 BTC during this dip. This suggests that “Smart Money” is viewing sub-$75k prices as a generational buying opportunity, even if they expect more “choppy” water in the short term.

Final Verdict: How Deep Will the Drop Go?

Technically, Bitcoin is now fighting to hold support at the $68,000 – $70,000 range. If this level fails, analysts at Kaiko and Wincent warn that we could see a retest of $60,000 before the end of Q1 2026. For now, the “Easy Money” era is over, and Bitcoin must find a new floor based on real-world utility rather than Fed-fueled hype.

Are you “HODLing” or folding? The 2026 market is proving to be the most volatile in years. Share your strategy in the comments below—are you buying the dip or waiting for $60k?